Petualangan Epik di Black Desert Fantasi dengan Grafis Terbaik Black Desert adalah salah satu MMORPG (Massively...

Metal Slug: Aksi 2D Tanpa Ampun dengan Gaya Kartun yang Melegenda Pendahuluan: Ketika Kekacauan Jadi Seni Dirilis...

Kota Para Berang-Berang: Game Strategi Unik dengan Sentuhan Alam dan Logika Teknik Saat banyak game city builder...

Merancang Keseimbangan Alam: Relaxing Puzzle Game dengan Pesan Ekologis Kuat Di tengah lautan game yang penuh kekacauan...

Dari Platformer PS2 Inilah Dunia Ajaib Jak and Daxter Di antara banyaknya game Platformer PS2 yang...

Dark Cloud 2 Petualangan Fantasi yang Layak Dikenang Dalam dunia video game, hanya sedikit judul yang...

Persona 4 Misteri Pembunuhan, Shadow, dan Kekuatan Dunia JRPG Persona 4 telah melahirkan banyak mahakarya, namun...

Mortal Kombat Kombinasi Fighting dan Adventure Sempurna Jika kita berbicara tentang game legendaris dari era PlayStation...

Soul Reaver 2 Gaya Visual dan Suasana Kelam yang Ikonik Ketika membicarakan game klasik dengan atmosfer...

Katamari Damacy dalam Pop Culture Dari Referensi Anime Sejak pertama kali dirilis, Katamari Damacy telah...

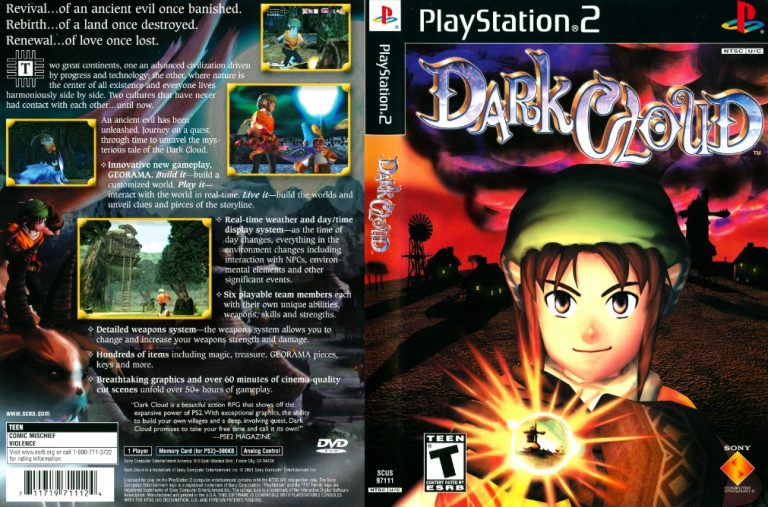

Dark Cloud Reminisce Menyelami Dunia Fantasi Klasik PS2 Era PlayStation 2 adalah masa keemasan...

Fatal Frame Horor Klasik yang Masih Menakutkan Hingga Kini Game Fatal Frame telah berkembang pesat...

Kastil Salazar Menyeramkan di Resident Evil 4 Laga Mematikan Resident Evil 4 adalah salah satu game...

Tokoh Paling Andal di Crash Tag Team Racing Crash Tag Team Racing (CTTR) adalah salah satu game...

Build Karakter Unggulan Genshin Impact yang Wajib Dicoba Genshin Impact adalah salah satu game RPG open-world yang...

Lethal Company: Kengerian dan Strategi dalam Dunia Paranormal Lethal Company, sebuah game horor indie yang memadukan elemen...

Sons of the Forest: Petualangan Bertahan Hidup di Pulau Penuh Misteri Sons of the Forest, sekuel dari...

Fallout 76: Petualangan Pasca-Apokaliptik dengan Dunia Multiplayer yang Luas Fallout 76, yang dikembangkan oleh Bethesda Game Studios,...

Project Zomboid: Bertahan Hidup di Dunia Zombie dengan Kebebasan Tak Terbatas Project Zomboid, game survival yang dikembangkan...

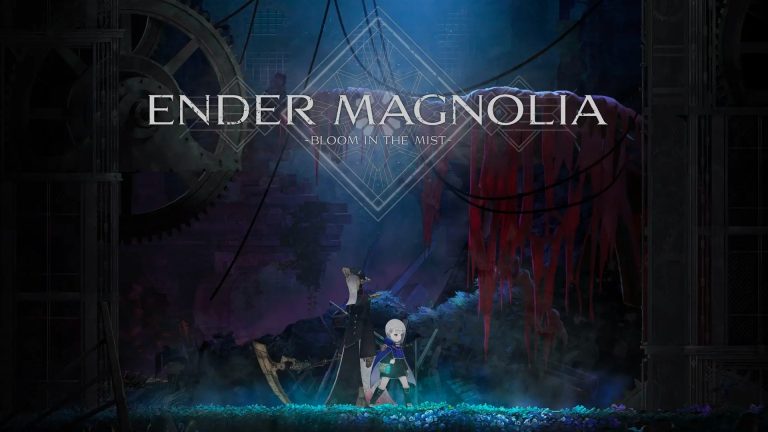

Ender Magnolia: Petualangan Epik dalam Kabut yang Misterius Ender Magnolia: Bloom in the Mist, game aksi-petualangan yang...

Perjalanan Cerita The Legend of Zelda Breath of the Wild Sejak debutnya pada tahun 1986, The Legend...